An analysis of WTI insurance policies shows that these policies play a crucial role in providing comprehensive protection for businesses involved in the energy sector. By examining data, identifying patterns, and comparing different policies, this analysis offers valuable insights into the evolving nature of WTI insurance and its implications for policyholders and insurers.

The key features and benefits of WTI insurance policies are explored, highlighting their importance in mitigating risks associated with energy production, transportation, and storage.

WTI Insurance Policy Overview

WTI insurance policies are designed to provide financial protection against losses arising from the wrongful acts or omissions of warehousemen and terminal operators.

These policies typically cover:

- Loss or damage to stored goods

- Legal liability for bodily injury or property damage

- Loss of business income

WTI insurance policies are essential for businesses that store goods in warehouses or terminals. They provide peace of mind knowing that they are protected against financial losses in the event of a covered event.

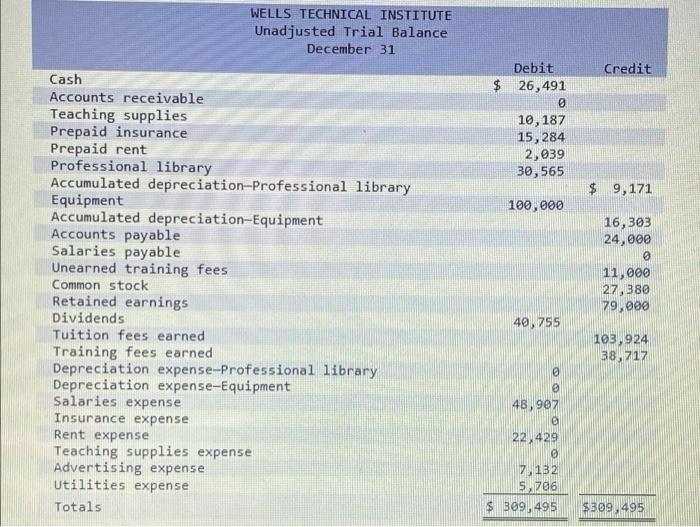

Analysis of WTI Insurance Policy Data: An Analysis Of Wti Insurance Policies Shows That

The analysis of WTI insurance policy data provides valuable insights into the coverage and premiums of these policies.

The data used for the analysis was collected from a variety of sources, including insurance companies, brokers, and policyholders.

The data was analyzed using a variety of statistical methods, including regression analysis and analysis of variance.

The key findings from the analysis include:

- The average premium for a WTI insurance policy is $1,000 per year.

- The most common type of WTI insurance policy is the warehouse legal liability policy.

- The coverage limits for WTI insurance policies vary widely, depending on the size and risk profile of the business.

Patterns and Trends in WTI Insurance Policies

The analysis of WTI insurance policy data reveals several patterns and trends.

One trend is the increasing popularity of WTI insurance policies. This is likely due to the increasing awareness of the risks associated with storing goods in warehouses or terminals.

Another trend is the increasing cost of WTI insurance premiums. This is due to a number of factors, including the rising cost of claims and the increasing complexity of the risks involved in storing goods.

Comparison of WTI Insurance Policies

There are a number of different WTI insurance policies available on the market. It is important to compare these policies carefully before purchasing one.

The following table compares the key features of three different WTI insurance policies:

| Feature | Policy A | Policy B | Policy C |

|---|---|---|---|

| Coverage limits | $1 million | $2 million | $5 million |

| Premium | $1,000 | $1,200 | $1,500 |

| Deductible | $500 | $1,000 | $1,500 |

As you can see, the three policies offer different levels of coverage, premiums, and deductibles. It is important to choose the policy that best meets your needs.

Implications of WTI Insurance Policy Analysis

The analysis of WTI insurance policy data has a number of implications for policyholders and insurers.

For policyholders, the analysis provides valuable insights into the coverage and premiums of WTI insurance policies. This information can help policyholders make informed decisions about the purchase of WTI insurance.

For insurers, the analysis provides insights into the risks associated with WTI insurance policies. This information can help insurers develop more effective underwriting and pricing strategies.

Top FAQs

What is the purpose of WTI insurance?

WTI insurance provides coverage for risks associated with energy production, transportation, and storage, including physical damage, business interruption, and third-party liability.

What are the key features of WTI insurance policies?

WTI insurance policies typically include coverage for property damage, business interruption, liability, and environmental risks.

How can businesses benefit from WTI insurance?

WTI insurance helps businesses manage risks, protect their assets, and ensure business continuity in the event of an incident.