Interactive online bank simulators, as the name suggests, are powerful tools that offer a realistic and engaging way to learn about personal finance and banking concepts. With the interactive online bank simulator answer key, you can unlock the full potential of these simulators and maximize your learning experience.

This guide will delve into the key features, educational value, user experience, and applications of interactive online bank simulators, providing you with a comprehensive understanding of their capabilities and benefits.

Interactive Online Bank Simulators

Interactive online bank simulators are virtual platforms that provide users with a realistic banking experience without the risks associated with real-world transactions. These simulators offer a safe and controlled environment for individuals to learn about financial management, practice banking skills, and make informed financial decisions.

Key Concepts

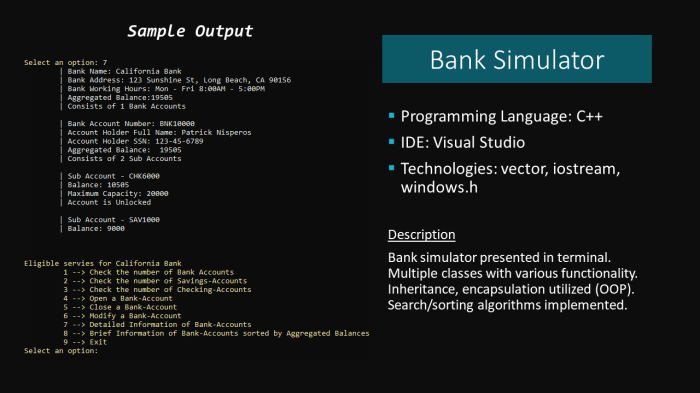

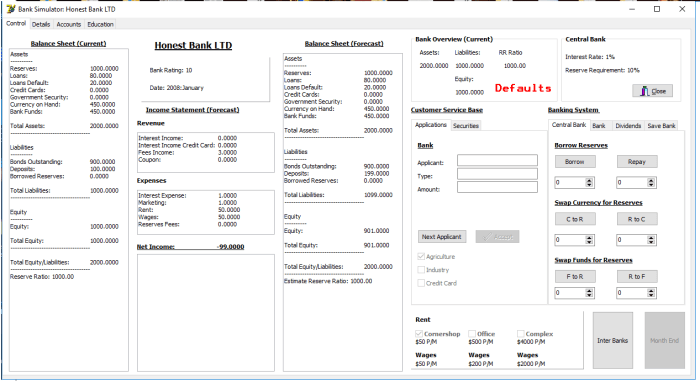

An interactive online bank simulator is a software application that mimics the functionality of a real-world bank. Users can create virtual accounts, deposit and withdraw funds, pay bills, apply for loans, and manage their finances. These simulators provide a realistic and engaging way to learn about banking and financial management.

Examples of interactive online bank simulators include:

- Bank of America’s MoneyTrack

- Wells Fargo’s My Virtual Wallet

- Chase’s Financial Fitness Center

Features and Functions

Interactive online bank simulators typically offer a wide range of features and functions, including:

- Account management: Users can create and manage multiple virtual bank accounts, including checking, savings, and investment accounts.

- Transaction processing: Users can perform real-time transactions, such as deposits, withdrawals, and transfers.

- Bill payment: Users can pay bills online, set up automatic payments, and track their payment history.

- Loan applications: Users can apply for virtual loans, including mortgages, auto loans, and personal loans.

- Financial planning: Some simulators offer financial planning tools, such as budgeting, investment tracking, and retirement planning.

| Simulator | Features |

|---|---|

| Bank of America’s MoneyTrack | Account management, transaction processing, bill payment, loan applications, financial planning |

| Wells Fargo’s My Virtual Wallet | Account management, transaction processing, bill payment, loan applications |

| Chase’s Financial Fitness Center | Account management, transaction processing, bill payment, financial planning |

Advantages of using an interactive online bank simulator:

- Safe and risk-free: Simulators provide a safe environment to practice banking without the risks of losing real money.

- Interactive and engaging: Simulators offer a hands-on and engaging way to learn about banking and financial management.

- Personalized: Simulators can be customized to meet the individual needs of users, allowing them to focus on specific financial topics.

Disadvantages of using an interactive online bank simulator:

- Not a substitute for real-world experience: Simulators cannot fully replicate the complexities and risks of real-world banking.

- May not be suitable for all users: Simulators may not be appropriate for users with complex financial needs or who are struggling with financial difficulties.

Educational Value

Interactive online bank simulators can be a valuable tool for financial literacy education. They provide a safe and engaging environment for individuals to learn about banking, budgeting, and other financial concepts. Simulators can also be used to teach students about the risks and rewards of different financial decisions.

Benefits of using interactive online bank simulators for financial literacy:

- Improved financial knowledge: Simulators can help users understand the basics of banking, budgeting, and other financial topics.

- Increased financial confidence: Simulators provide a risk-free environment to practice financial skills, which can boost users’ confidence in their ability to manage their finances.

- Reduced financial risk: Simulators can help users make informed financial decisions by allowing them to experiment with different scenarios without the risk of losing real money.

Examples of how simulators have been used in educational settings:

- High schools: Simulators have been used to teach students about personal finance and budgeting.

- Colleges and universities: Simulators have been used to teach students about financial planning and investment.

- Nonprofit organizations: Simulators have been used to provide financial literacy training to low-income and underserved communities.

User Experience, Interactive online bank simulator answer key

The user experience of interactive online bank simulators is crucial to their effectiveness. A positive user experience can make simulators more engaging and motivating, while a negative user experience can discourage users from using them.

Key factors that contribute to a positive user experience:

- Intuitive interface: Simulators should be easy to navigate and use, with clear instructions and helpful tutorials.

- Realistic simulations: Simulators should provide a realistic banking experience, with accurate transactions and realistic consequences for financial decisions.

- Engaging content: Simulators should offer a variety of engaging content, such as interactive exercises, quizzes, and games.

- Personalized feedback: Simulators should provide personalized feedback to users, helping them to identify areas for improvement and track their progress.

Ways to improve the user experience of interactive online bank simulators:

- Use clear and concise language.

- Provide helpful tutorials and instructions.

- Offer a variety of engaging content.

- Personalize feedback to users.

- Test the simulator with users to get feedback and identify areas for improvement.

Applications

Interactive online bank simulators have a wide range of applications in different industries and sectors. They can be used for:

- Financial literacy education: Simulators can be used to teach individuals about banking, budgeting, and other financial topics.

- Employee training: Simulators can be used to train employees on financial topics, such as expense management and fraud prevention.

- Product development: Simulators can be used to test new financial products and services before they are released to the public.

- Research: Simulators can be used to conduct research on financial behavior and decision-making.

Case studies or examples of successful applications:

- A major bank used a simulator to train its employees on new anti-fraud measures. The simulator helped employees to identify and prevent fraudulent transactions, resulting in a significant reduction in fraud losses.

- A non-profit organization used a simulator to teach low-income families about budgeting and financial planning. The simulator helped families to develop realistic budgets and reduce their debt.

FAQ Resource: Interactive Online Bank Simulator Answer Key

What are the key features of interactive online bank simulators?

Interactive online bank simulators typically offer a range of features, including account management, budgeting tools, loan and investment simulations, and interactive tutorials.

How can interactive online bank simulators be used for educational purposes?

Interactive online bank simulators can be used to teach students about banking concepts, financial planning, budgeting, and investing in a hands-on and engaging way.

What are the benefits of using interactive online bank simulators?

Interactive online bank simulators provide a safe and risk-free environment for users to learn about banking and finance, make financial decisions, and manage their finances effectively.